Matching

Real-time FIN MT confirmations matching module

The Matching module enables real-time matching of MT messages based on user-defined rules. Aimed to achieve improved efficiency, increased STP and reduced settlement risk.

What's included?

- Out-of-the-box settings for Treasury, Securities and Settlements reconciliation

- GUI administration for custom matching rules definition, for any MT

- Support for automatic and manual matching with detailed message compare tool

- Matching process and results search and monitoring

- Inbound and outbound matching flows, regardless of the initiator of the confirmation exchange

Especially suited for organizations looking for an in-house solution to match all its trade operations, regardless of counterparty subscriptions.

Main Features

Out-of-the-box Matching Rules

The matching is driven by user-defined rules. The module is preset to cover Treasury, Securities messages and Settlement reconciliation (similar to the discontinued SWIFT Accord). The rules are configured by API, and new rules can be added for any MT.

Inhouse Solution

It does not depend on the counterparty using the same reconciliation system. The module can be integrated and run as a standalone solution, pairing all your sent and received trade operations.

Matching and Chaining

Rule configurations support both matching and chaining; to pair message confirmations exchange with a counterparty, or to link a sequence of sent or received messages that belong to the same trade.

Manual Matching

When the automated matching produces mismatches or unmatched, confirmations can be manually reviewed in the GUI. A detailed message compare tool is provided to analyze the matching candidates and select a proper match.

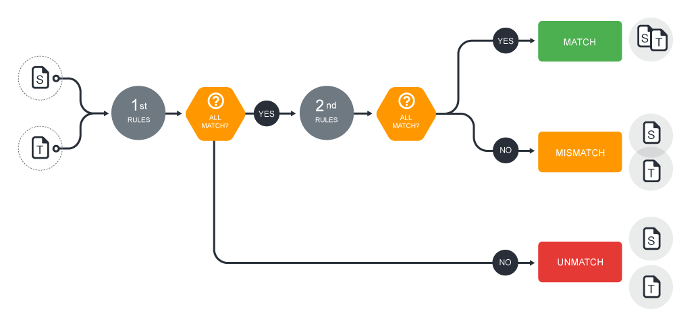

Given a source and target message, the matching process determines if the messages belong to the same trade, and can produce three different outcomes:

- Matched: The messages correspond to the same trade, and all rules are completely satisfied.

- Mis-Matched: the messages are related to the same trade, but some details differ.

- Un-Matched: the messages are not related.

01

Un-Matched

The primary rules define the fields that must correspond in the two messages to consider them as related to the same trade. If this fields differ the matching result is UN-MATCHED.

02

Mis-Matched

If all fields from the primary rules match, the process continues with the set of secondary rules. Then if discrepancies are detected in these secondary fields, the matching result for the pair of messages is MIS-MATCHED.

03

Matched

Finally, if the process does not detect any discrepancies in either the primary and secondary fields, then the pair of messages is considered to be successfully MATCHED.